This simple investment strategy can help reduce guesswork — and help reduce the risks of emotional investing.

For most investors, the key to success is simple: Buy low and sell high. But oftentimes, a scenario like the following plays out:

- When the market is up, an investor feels good and buys stocks.

- When the market is down, that same investor gets scared and sells.

Although reacting like this may feel instinctively right at the time, buying high and selling low is unlikely to result in a profit.

Why do investors do this? The reason may have a lot to do with us making investment choices the same way we make many important decisions: using both our heads and our hearts (in other words, both logic and emotion). When there’s market volatility — including both market highs and market lows — our emotions tend to take over and we may make illogical choices that go against our best interests.

Rather than falling victim to the potential perils of emotional investing, you may want to be completely logical: Get into the market when it’s down and out when it’s up. This is known as market timing. While this approach sounds rational, the problem is that it’s extremely difficult, even for experienced investors, to do consistently. There’s an old saying: No one rings a bell when the market reaches the top of a peak or the bottom of a trough. Translated, that means anyone attempting to time the market finds it difficult to know exactly when to make a move.

For example, if you think the market has reached a peak and get out and then share prices keep rising, you’ll miss out on the additional profits you could have made by waiting. And after you get out, how do you know when to get back in? If you act too quickly, you’ll forgo better bargains as prices continue to fall. If you wait too long, you may sacrifice the chance to fully benefit from a market rally.

Give dollar cost averaging a look

To help reduce the potential problems of emotional investing and market timing, consider a strategy called dollar cost averaging.

Dollar cost averaging is the practice of putting a set amount into a particular investment on a regular basis (such as weekly, monthly, or quarterly) no matter what’s going on in the market. For example, you could invest $500 each month. In a fluctuating market, this practice lets you purchase:

- Additional shares at a bargain when prices are low

- Fewer expensive shares when prices increase

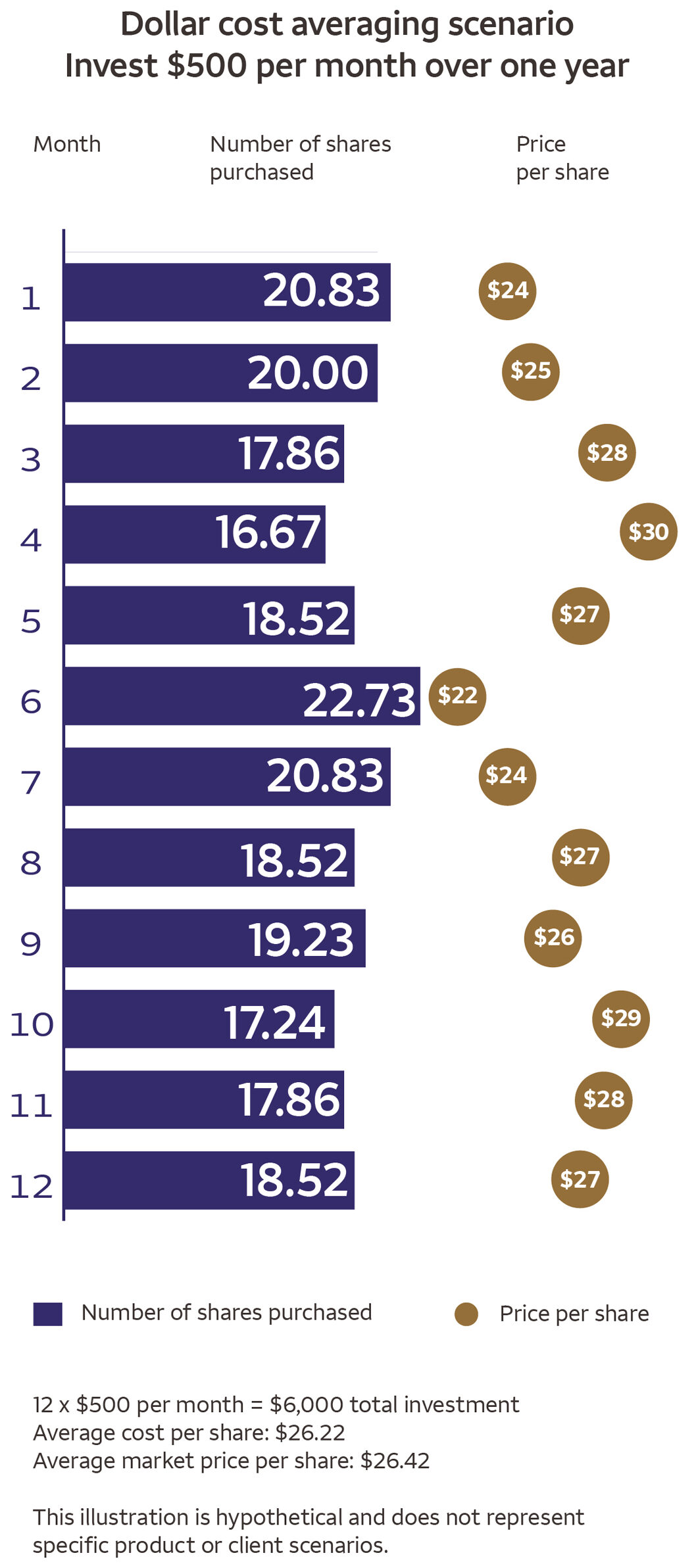

As shown in the table below, if the price is $24 per share, you’d buy 20.83 shares. (Keep in mind that mutual funds let you purchase fractional shares.) If the price rises to $30, you would buy only 16.67 shares.

Dollar Cost Averaging Scenario: Invest $500 per Month Over One Year

This infographic visually represents how dollar cost averaging works by showing monthly investments of $500 over a 12-month period. It uses a three-column layout with color-coded visuals to convey the number of shares purchased and the price per share each month.

Layout Description

- The first column on the left lists the months from 1 to 12 in ascending order.

- The second column, in the center, displays the number of shares purchased each month. Each value is shown inside a horizontal purple bar—the longer the bar, the more shares were purchased.

- The third column, on the right, shows the price per share for each month. Each price is enclosed in a brown circle, with the circle’s horizontal position indicating relative cost—further right means a higher price.

Monthly Breakdown

- Month 1: 20.83 shares at $24

- Month 2: 20.00 shares at $25

- Month 3: 17.86 shares at $28

- Month 4: 16.67 shares at $30

- Month 5: 18.52 shares at $27

- Month 6: 22.73 shares at $22

- Month 7: 20.83 shares at $24

- Month 8: 18.52 shares at $27

- Month 9: 19.23 shares at $26

- Month 10: 17.24 shares at $29

- Month 11: 17.86 shares at $28

- Month 12: 18.52 shares at $27

Infographic Summary

- Total investment: 12 months × $500 = $6,000

- Average cost per share: $26.22

- Average market price per share: $26.42

Infographic Disclaimer

This illustration is hypothetical and does not represent specific product or client scenarios.

In a fluctuating market, dollar cost averaging will result in an average cost per share that’s less than the average market price per share. The average market price per share in the table (the sum of the market prices [$317] divided by the number of purchases [12]) is $26.42. However, the average price per share (the total invested [$6,000] divided by the number of shares purchased [228.81]) is only $26.22.

While you’re contemplating the potential merits of dollar cost averaging, consider this: You may well be using the strategy already. If you participate in an employer-sponsored retirement plan, such as a 401(k) or 403(b), and contribute the same amount each payday, you’re using dollar cost averaging.

Get help for when the going gets tough

One of dollar cost averaging’s challenges is that you have to stick with the strategy even when the market declines, and that can be difficult (see our previous discussion about emotional investing). Dollar cost averaging does not assure a profit or protect against a loss in declining markets. However, during times like these, dollar cost averaging can be most useful by letting you purchase shares at lower prices.

Because dollar cost averaging can be simultaneously more difficult and potentially advantageous when the going gets toughest, consider turning to a professional financial advisor for help.